|

|

|

|

|

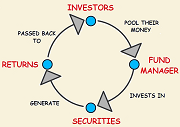

One needs more than cash on hand to keep up with the rising cost of living. Investments in the stock market are required and the best way to do that is with mutual funds. In addition to consistent returns, mutual funds have the inherent advantage of diversification, reducing risk. Evaluating, choosing, tracking, and trading individual stocks requires far more time and attention than the average person can provide. So, rather than trying to predict the future of individual companies, itís better to let the pros and their computerized systems do it for you by investing in a set of mutual funds. |

|

|

|

|

|

|

|

|

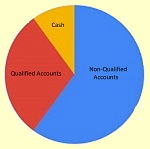

Sort your financial assets into three parts (for this discussion, personal property and real estate will be ignored). The first is the money that you need to manage the ebb and flow of your current needs. You don't want to put that in mutual funds and be forced to sell at an inconvenient time. Keep those funds in checking and savings accounts. The second part will be qualified funds, which is an IRA and/or 401(k) Plan. Those assets are not ready cash; there are penalties for early withdrawal. The third part will be non-qualified (taxable) assets. Having defined the available assets, you can select a set of mutural funds.

|

|

|

|

|

|

|

|

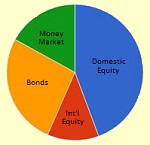

For your investment portfolio, you will want mutual funds in at least three categories: Money Market (stable cash), Corporate Bonds (fixed income) and Equity (corporate stocks). If sufficient funds are available, you should further divide the Equity portion into domestic and international funds for optimal return. From a reputable investment group, select mutual funds in these categories which have demonstrated a good track record in dealing with the ups and downs of the market. Morningstar provides an analysis of many mutual funds and assigns a Morningstar Analyst Rating, which expresses their confidence in a fund's ability to beat or match its historic returns going forward.

|

|

|

|

|

|

|

After the funds are identified, allocate the total of your non-qualified and qualified accounts to the funds according to a target allocation that is appropriate for your situation. Age is a key factor because risks of medical expenditures and reduced income increase as you age. In your earlier years, you can afford to take more risk for greater reward than later in life when you rely on your savings and investments for income. While thereís not a single answer right for all situations, a set of charts suggests target allocations, as a function of age (click link below).

Suggested Allocations with Respect to Age. Suggested Allocations with Respect to Age.

|

|

|

|

|

|

|

|

Allocating your assets to match your targets is not a one-time event. Reviewing your targets and rebalancing your funds must be ongoing; it is the key to successful mutual fund investing. This is because all funds will not experience uniform growth or decline. Thus, you should review and update your targets once a year and rebalance the assets in your funds to match the targets twice a year. This keeps the allocation of your assets in line with your targets. The process is not difficult and automatically causes you to sell some assets that have increased in value and buy some assets that have decreased in value. And that's exactly what you should do: buy low and sell high.

|

|

|

|

|

|

|

Remember, your investment portfolio should not include money required to meet current needs. Keep that in checking and savings. The cash in your investment portfolio is the sum of money market funds held in all accounts. Also, be aware of potential tax consequences when selling assets in a non-qualified account. Sales will increase tax liability (if a capital gain) or reduce tax liability (if a loss). Tax considerations also suggest preferred accounts for a mutual fund in. Bond funds, for example, are best held in qualified accounts to avoid taxes on monthly dividends. At the same time, international stock funds should be in non-qualified accounts because foreign tax payments can reduce your U.S. tax payments. One may also hold the same domestic equity fund in both qualified and non-qualified accounts for added flexibility in rebalancing.

|

|

|

|

|

|

|

Rebalancing the portfolios need not be a complicated process. While one could develop sophisticated optimization routines on Excel spreadsheets with Solver, a simple breakdown of the assets in each category on a sheet of paper provides sufficient insight for rebalancing (see

sample worksheet).

|

|

|

|

|

|